Explain the factors determining the return on investment

Then the interest return on the investment would be 20 the annual saving of 1000 divided by the 5000 initial cost and the. The officer should explain the reasons why the applicant has not met the eligibility requirements.

Market Risk Premium Market Risk Financial Management Investing

Finance is the study and discipline of money currency and capital assetsIt is related with but not synonymous with economics the study of production distribution and consumption of money assets goods and servicesFinance activities take place in financial systems at various scopes thus the field can be roughly divided into personal corporate and public finance.

. This is just a brief overview of the SCOR model. Draw a hypothetical investment demand curve and explain what it shows about the relationship between investment and the interest rate. The model enables full leverage of capital investment creation of a supply chain road map alignment of business functions and an average of two to six times return on investment 4.

It can also be used however to evaluate the overall impact of a programme in quantifiable and monetised terms. The main determining factors for SMEs are staff headcount and turnover. Another important consideration includes evaluating the lands potential rate of return.

The bank determines that during the 2015 tax year the business had an average number of 30 employees and that for the same tax year the businesss gross receipts were 3000000 and its assets consisted entirely of inventory and working capital. We would like to show you a description here but the site wont allow us. Here Proportion of Debt is 75 Proportion of Equity will be 1-75 25 Cost of Debt is 5 Risk.

Your sites content should conform to best practices as disclosed in the Search Quality Ratings Guidelines with an emphasis on. The IRR calculation for this scenario is rate of return of -1022 which reflects the unfortunate fact that while the gain was 100 in January and the loss was just 30 in February the loss receives a much higher weighting because the investor added dollars to the portfolio just before the loss and had far. The Sharpe ratio is the average return earned in excess of the risk-free rate per unit of volatility or total risk.

Required Rate of the is the return expected out of the investment made. 1 The sources of the valuation materials listed in the bibliography are the Commission and the Commission staff with the exception of the guidance jointly issued by the Commissions Office of the Chief Accountant and the staff of the Financial Accounting Standards Board FASB supra in IVStaff Guidance. Investment Research tries to capitulate all the factors that influence an underlying assets price.

If the item has been recently bought or sold that can be a good indicator of its fair market value. They impact the real return of an investors portfolio. What is the expected return on the firms stock A.

Comparable sales opportunity costs and price per acre are all good benchmarks to factor into a land purchase. Idea generation screening concept development product development and finally commercialization. For micro-sized enterprises the staff headcount is less than 10 employees with a turnover of less than EUR 2 million.

Determining the value of a real estate investment can be a challenge especially when it comes to farmland. Subtracting the risk-free rate from the mean return the. To allow clients and prospective clients to evaluate the risks associated with a particular investment adviser its business practices and its investment strategies it is essential that clients and.

A retail clothing business submits an application for a loan from a community bank on February 1 2016. Please note that the terminology used in the. Sole proprietorships are easy to set up and generally only require a small influx of initial investment.

Being unique and offering value. Investment advisers provide a wide range of advisory services and play an important role in helping individuals and institutions make significant financial decisions. As a technique it is used most often at the start of a programme or project when different options or courses of action are being appraised and compared as an option for choosing the best approach.

It is common for SMEs to assume a sole. The field of identifying these factors and using it for the benefit of. CBA adds up the total costs of a programme.

Cost or selling price. Five phases guide the new product development process for small businesses. They go as follows.

But exchange rates matter on a smaller scale as well. Sales of comparable assets. Even if the positive factors outweigh the negative factors discretion cannot be used to approve an application if the applicant does not meet the other statutory or regulatory requirements.

The SCOR model has proven to benefit companies that use it to identify supply chain problems. Discuss the factors that can cause an investment demand curve to shift. For example while analyzing the performance of a mutual fund Mutual Fund A mutual fund is a professionally managed investment product in which a pool of money from a group of investors is invested across assets such as equities bonds etc read more an investor.

There are four basic methods of determining fair market value. No the negative factors outweigh the positive factors. Similarly investing in stocks is also determined by a set of factors which would influence the return possibilities.

Assessing Fair Market Value. Here we look at some of the major forces behind exchange rate movements. When a real estate agent presents a prospective home seller with a list of recent sales prices for.

IRR Dollar-Weighted Return.

What Is Return On Investment Roi Definition Faqs

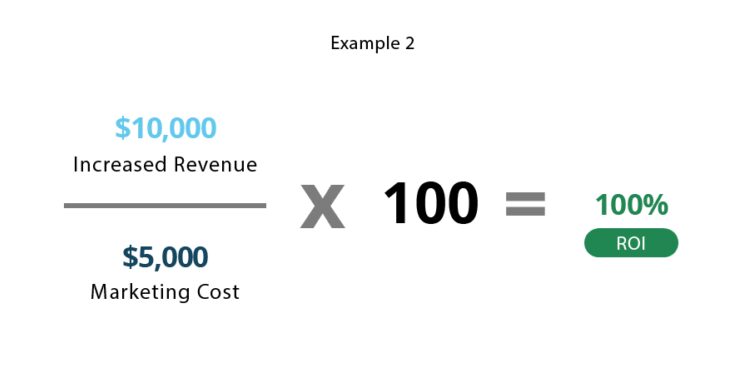

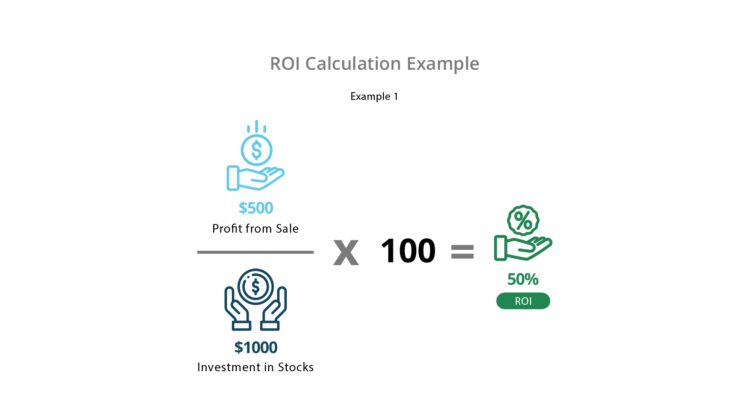

Return On Investment Roi Definition Equation How To Calculate It

Factors Affecting Cost Of Capital Cost Of Capital Financial Management Economic Environment

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

Determining Risk And The Risk Pyramid

Return On Investment Roi Formula Meaning Investinganswers

Pin On Charltons

Portfolio Investment Investing Time Management Tips Accounting And Finance

Return On Investment Roi Formula Meaning Investinganswers

Roe Vs Roa Top 7 Differences To Learn With Infographics Stock Trading Strategies Business Valuation Project Finance

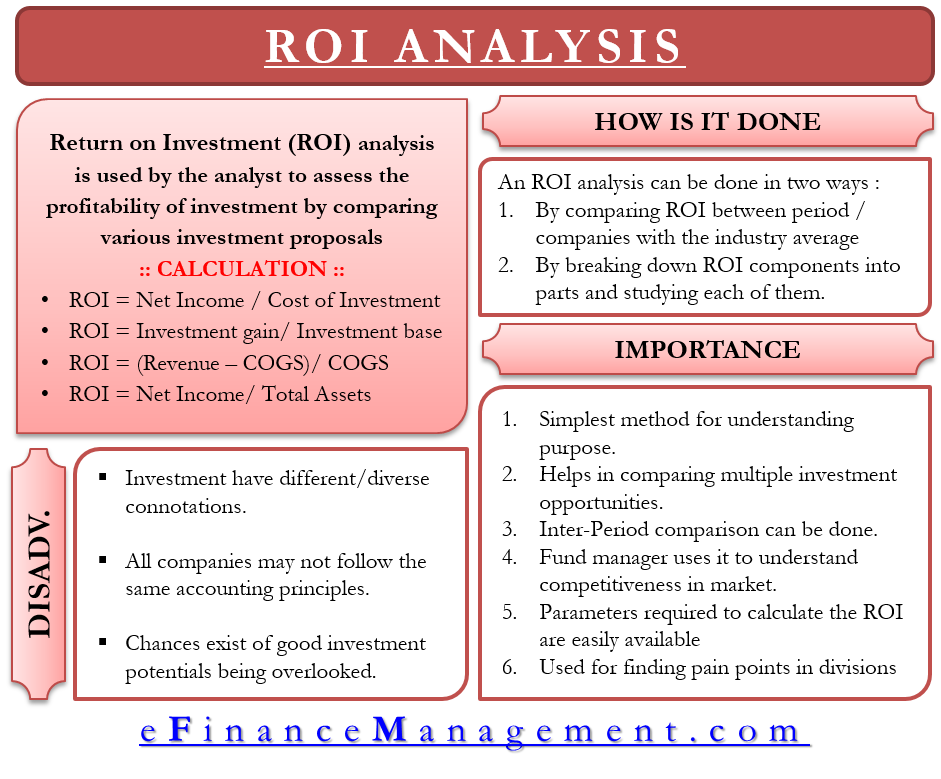

Roi Analysis What It Is And Why It Is Important

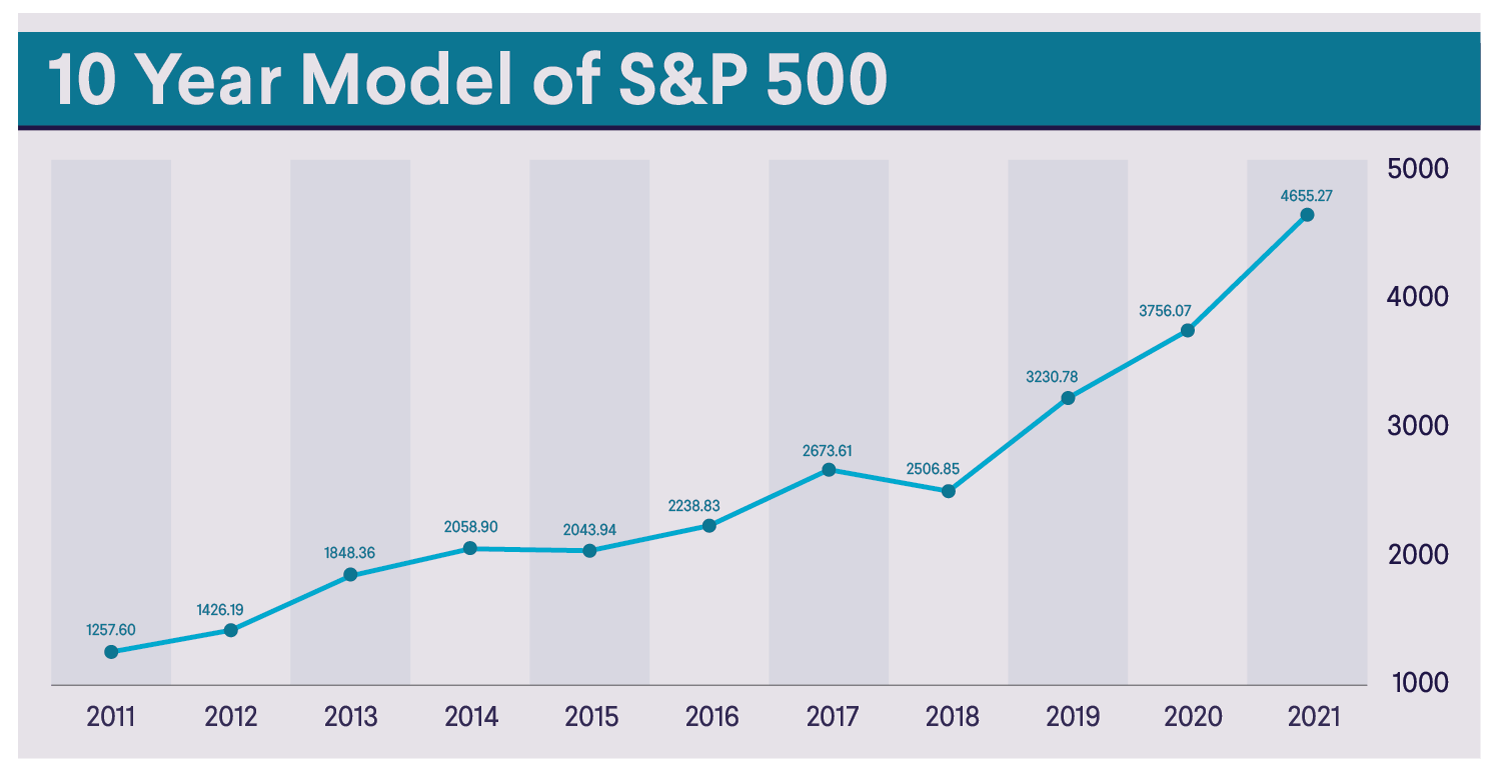

What Is Considered A Good Return On Investment Sofi

Customer Relationship Management Crm What Is The Roi From Crm Relationship Marketing Relationship Management Customer Relationship Management

Return On Investment Roi Roi Accounting Investing Return On Assets Economy Lessons

:max_bytes(150000):strip_icc():gifv()/ExpectedReturn_Final_4196761-41e27ce95bd144a8a783ada8815b920a.png)

Expected Return Definition

.jpg)

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Roi Definition Equation How To Calculate It

Internal Rate Of Return Irr Formula And Calculator